Social Security is a social welfare program. It’s huge and--based on how many people rely on it--immensely popular. Over 52 million Americans receive benefits from this massive program. This makes Social Security arguably the most important retirement plan in the country.

Social Security provides retirement income for eligible participants, their spouses, and other dependents in some cases. It’s a stream of income guaranteed by the US Government, paying the earner a monthly paycheck for the rest of their life. The payments have a cost of living increase as well, making them a valuable protection against inflation.

How to Become Eligible

You must be “fully insured” to reap the full benefits of Social Security. To become fully insured, you must earn 40 credits. In 2018 you receive one credit for every $1,320 earned and the most credits you can earn in one year is 4. So, to become fully insured you need to earn 4 credits per year for 10 years. Once you’re fully insured, you’re insured for life, meaning you’re eligible for your retirement income benefit (though, as we’ll see, the amount you actually receive may vary).

How Much is My Monthly Benefit?

Your monthly benefit, or PIA, is based on three factors:

- How long you’ve worked

- How much you earned

- A government indexing factor called AIME

Since the last factor is out of your control, we’ll focus on the first two. Social Security looks at your 35 highest earning years up to age 60 to determine your benefit. Once you turn 60, one earning year can potentially replace a lower earnings year within your 35 earlier years.

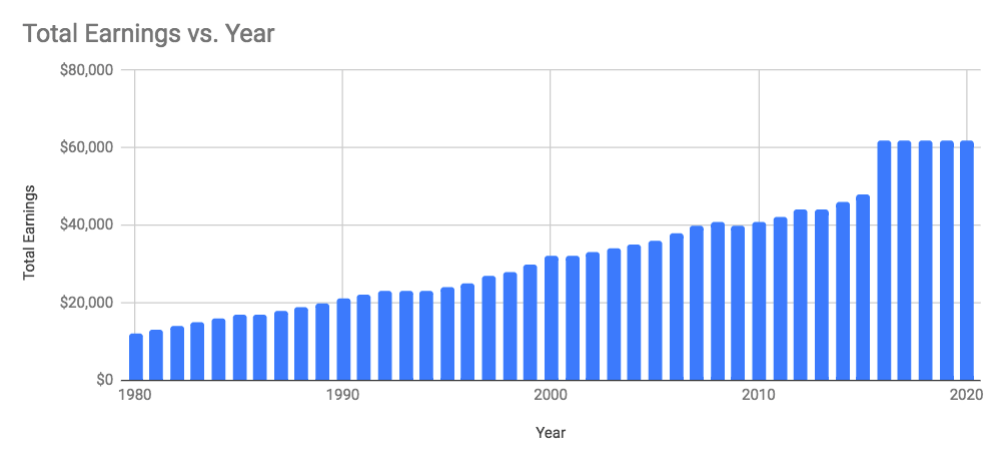

For example, if you started working at age 25 in 1980, 35 earning years later you’re 60 and nearing retirement. I don’t know about you, but when I was 25 I wasn’t making much money (even after considering inflation). Fortunately, you are allowed to “replace” these lower earning years by continuing to work beyond age 60, assuming you earn more income than you did in any of your previous 35 working years (adjusted for inflation).

In this illustration, the higher earning years from 2016 through 2020 could replace lower earning years, potentially increasing this earners overall monthly benefit (PIA).

Social Security also looks at how much you’ve earned. Generally, the more money you earn, the higher your benefit will be, up to the taxable wage base. In 2018, the taxable wage base is $128,400. Anyone earning $128,400 or more this year will not pay any more in Social Security taxes, and as a result, their final monthly benefit (PIA) will be limited as well. In 2018, the maximum monthly benefit for a earner at full retirement age is $2,788.

What are the Other Benefits of Social Security?

Social Security is not without its flaws, contradictions and complexities, but it still provides some significant financial benefits. I’ve highlighted just a few below:

1. A guaranteed income stream

Social Security can be looked at as an insurance tool. It’s insurance against 1) not having any money in retirement (though it rarely provides ALL that you need), and 2) potentially running out of money before you die. Social Security provides monthly income guaranteed for the eaner and and typically their spouse for the rest of your lives.

2. An increased income stream (if you’re patient)

Your Social Security benefit is not locked in place. Depending on WHEN you claim your benefit, you could earn substantially more income. In most cases, at age 66 you’re at your “full retirement age,” meaning you’re eligible for your full benefit, but waiting until age 70 could mean an increase to your benefit of 8% each year until age 70 when your benefit maxes out. Claiming between age 62 and your full retirement age will mean a permanently reduced benefit.

3. Spousal benefits

The earning spouse is not the only one entitled to benefits. A spouse can also receive benefits, either based on their own earnings or the earnings of the working spouse. A spouse opting into the spousal benefit receives 50% of the working spouse's benefit. Once the earner passes away, the spouse receives the earner's full benefit.

4. Increasing with inflation

Your Social Security benefit increases with inflation as well, meaning your Social Security dollars don’t lose purchasing power over time (compared to tucking cash under your mattress). This is called the COLA (Cost of Living Adjustment). It happens each January if inflation has occurred in the previous year.

America's Most Important “Retirement Plan”

I mentioned earlier the dependence of most Americans on Social Security. Because this plan is such a large supplement to one’s retirement income, it’s importance shouldn’t be overlooked, and retirees should be very thoughtful when deciding when to claim (see item 2 and 3 above).

But it’s important to remember that Social Security was never designed to provide for all of your retirement (hence, the quotes I added to the article title). It’s a supplement program. This is evident when considering the average social security benefit in 2018: it’s only about $1,400. That’s not enough for most retirees to be living on, even without big expenses like the costs of retirement savings or a mortgage.

Social Security must be viewed as a retirement income supplement, and every earner should go to lengths to have a savings plan to further fund their retirement needs.

I hope this has been a helpful primer on how Social Security works. I’ve only skimmed the surface with this post, and I’ll write posts in the future discussing Social Security in more detail. I offer a free 30-minute analysis to help retirees understand their benefit and how to increase it. If you’re interested, please contact me.