As last year’s U.S. Congressional session approached the Christmas holiday, a little known bill called the SECURE Act was once again teetering on the edge of failure. However, at the last minute it was tacked onto the year-end appropriations bill in order to keep the government funded. Just like that, a new series of financial rules and requirements impacted millions of American’s financial lives, though most don’t even know about it.

Following is a brief rundown of the SECURE Act’s 1,000+ page rule, with a focus on the areas that I feel would most likely impact you.

Stretch IRAs Have Been Drastically Limited

Before the SECURE Act was signed into law, anyone who inherited an IRA was required to take distributions from the IRA account. However, a very beneficial rule allowed inherited IRA distributions to be “stretched” over the life of the inheritor. For example, if a 45 year-old’s mother passed away leaving her a partial inheritance through an IRA, the 45 year-old would be required to take distributions from the IRA each year; however, the distributions could be spread out (or stretched) over the 45 year-old’s entire life. This minimizing of inherited IRA distributions meant that taxes on those distributions could be kept relatively low.

With the new law, however, the Stretch IRA has lost much of its prior “elasticity.” The new rule requires Inherited IRAs (those inherited in 2020 and beyond) to be fully distributed within 10 years, rather than over 20, 30...even 40 years or more.

A few brightsides are of note. First, distributions do not need to happen evenly. If it makes sense to take no distributions from your Inherited IRA in the first few years and then ramp up those distributions in the later years, you can do so, as long as the full amount is withdrawn by the end of year 10. Here’s a helpful example from financial planner Michael Kitces:

“On January 20, 2020, Josh’s father passed away, leaving Josh his $400,000 IRA. Josh, who is currently age 60, is still working and earns roughly $150,000 per year, but plans to retire in 5 years, at age 65. Given the fact that Josh’s income will substantially decrease when he retires, it may make sense for him to avoid taking any distributions from the inherited IRA while he is still working (i.e., during the first 5 years of the distribution window provided by the 10-Year Rule). Instead, he can opt to distribute the funds during years 6-10, when he expects his income to be much lower after his wages are gone (and before he begins Social Security benefits).”

It’s important to note as well that Stretch IRAs are still permitted for spousal beneficiaries, but in most cases children beneficiaries will be subject to the new rule.

Roth conversions can also help sidestep the consequences of the new 10-year rule for one’s heirs. Roth conversions involve converting IRA funds to Roth IRA funds and paying the taxes immediately on the funds converted. Roth IRA funds (whether inherited or not) have no required distribution, because the contributions have already been taxed. If you plan to leave a portion of your IRA to your heirs for an inheritance, you should seriously consider tactful Roth conversions.

If you’re the giving type, you can also satisfy your required distributions by taking qualified charitable distributions from your IRA. This could be particularly attractive to those who typically pay their charitable distributions in cash, since you’re making your charitable contributions with pre-tax dollars instead.

RMDs for IRAs Now Start at Age 72

Up until now, IRA required minimum distributions, or RMDs, had to begin by age 70 ½. With the new rule, that age has been upped to 72.

This change isn’t earth-shattering, but any ability to delay RMDs from retirement accounts is a welcome one by most retirees. In addition, it eliminates that annoying “½” year retirees needed to consider. [Note: The severe penalty for missing your RMD remains in force. If RMDs apply to you, make sure you’re taking them every year and for the correct amount!)

Having a Baby? There’s Now an IRA Exception for That!

Generally speaking, distributions from an IRA before age 59 ½ are subject to a steep 10% penalty on the amount withdrawn, in addition to income taxes owed. There are currently several exceptions to this, including withdrawals for a first-time home purchase (up to $10,000) and certain medical expenses.

With the SECURE Act, a new exception has been created allowing a penalty-free distribution of up to $5,000 from an IRA for a qualified adoption or birth-related expenses. In addition, both spouses can qualify for the exception if they each have an IRA, allowing for up to $10,000 withdrawn without penalty. The rule doesn’t appear to restrict the number of children, only that it can occur once per year. Plus, while not required, you can put the money back into your IRA at a later date without it counting as a contribution for tax purposes, even years later.

I know several families for whom this exception could be a real game changer. We all know medical costs are running rampant, far outstripping general inflation. Couples may have retirement funds saved, but cash flow to cover deductibles for having a baby or adopting may not be readily available. While using retirement funds for anything other than retirement isn’t ideal, it may be the next best thing. Plus, try telling a couple desperate to birth or adopt a child that they shouldn’t use retirement funds for it.

529 Funds Can Now Be Used for Apprenticeships

We’ve all been hearing about the rise in trade-related job demand. While college degrees still hold value, trades allow workers to follow an untraditional track and take those skills into quite lucrative professions...without 4+ years of schooling to get there.

The SECURE Act is acknowledging this trend, and will now permit 529 funds to go toward paying for apprenticeships. The value of this is nicely summarized in a Forbes article I read recently:

“In the past ten years over 600,000 Americans have completed nationally registered apprenticeship programs, according to the Department of Labor. With passage of the SECURE Act, children and young adults who want to become tradespeople would be able to use a 529 plan to help support that path. Skilled labor demand is at an all-time high, with skilled trades topping the list of most in-demand roles worldwide for the sixth year in a row, according to ManpowerGroup.”

“Not only that, skilled labor pays well. The typical four-year college grad will earn between $48,400 and $50,004 depending on your data source (Payscale, NACE). Meanwhile, Salary.com shows a carpenter earns between $48,000 and $64,056, an electrician between $42,462 to $55,034, and a plumber between $49,302 to $64,851. In a city like Boston a plumber can easily make $73,200 or more, and never run out of work.”

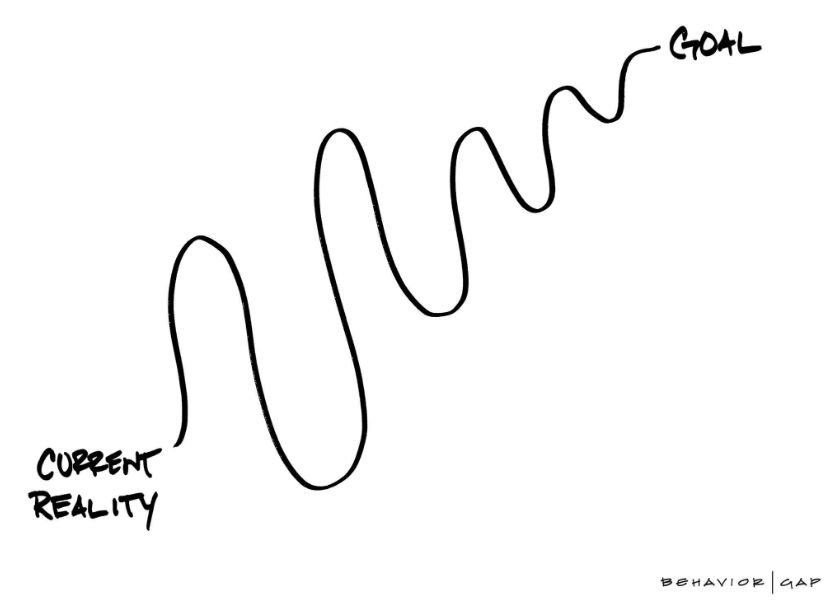

New Laws Present New Financial Planning Opportunities

As we saw with the Tax Cuts and Jobs Act in 2017 and now the SECURE Act in 2019, reality makes one’s goals a moving target. As the financial landscape continues to change, you may benefit from working with a financial planner to help navigate the changes.

If you have any questions about how this new law may impact your financial choices, please reach out to me.