Photo by Vincent Ledvina on Unsplash

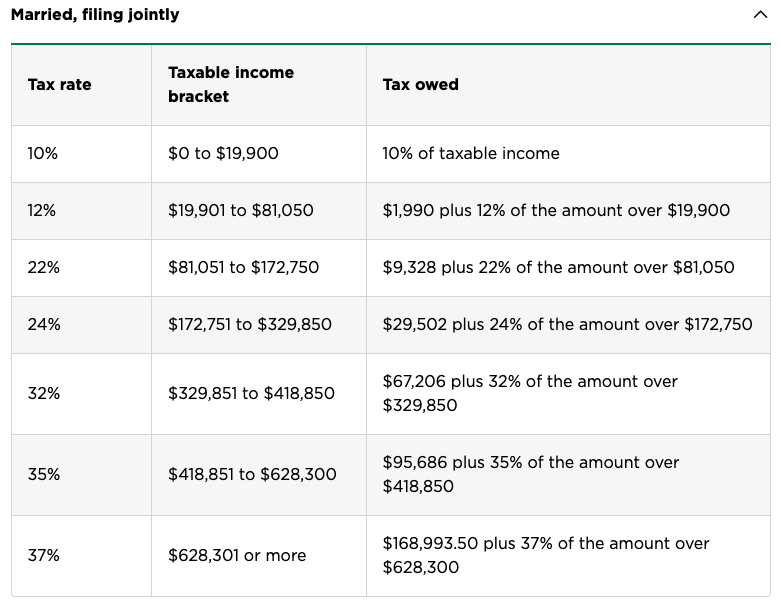

Federal income taxes are fairly straightforward for most individuals during their working years. In a progressive income tax system like ours, you pay taxes at a certain rate. Once your income exceeds the top tier of that rate bucket, the next dollar you earn is paid at a higher rate.

For example, a married couple earning $120,000 per year pays 10% federal income tax on their first $19,900, 12% tax on the next $61,149 ($81,050-$19,901), and 22% on the final $38,951.

But most retirees' income comes from a variety of different sources, most of which play by slightly different (or in some cases very different) tax rules.

Let’s take some time to look more closely at how various income sources are taxed in retirement.

Social Security

Some people grumble about needing to pay taxes on Social Security benefits, but fortunately these payments are taxed differently in retirement depending on your total income.

The taxation of Social Security payments can be a little complicated. To keep things clear, below is a helpful breakdown from Mike Piper at the Oblivious Investor:

Each year, the portion of your Social Security income that’s subject to federal income tax depends on your “combined income.” Your combined income is equal to:

Your adjusted gross income (line 11 on the 2021 version of Form 1040), not including any Social Security benefits, plus

Any tax-exempt interest you earned, plus

50% of your Social Security benefits.

If your combined income is below $25,000 ($32,000 if married filing jointly), none of your Social Security benefits will be taxed.

For every dollar of combined income above that level, $0.50 of benefits will become taxable until 50% of your benefits are taxed or until you reach $34,000 of combined income ($44,000 if married filing jointly).

For every dollar of combined income above $34,000 ($44,000 if married filing jointly), $0.85 of Social Security benefits will become taxable — all the way up to the point at which 85% of your Social Security benefits are taxable.*

Important note: to say that 85% of your Social Security benefits are taxable does not mean that 85% of your benefits will disappear to taxes. Rather, it means that 85% of your benefits will be included as taxable income when determining your total income tax for the year.

An important point here is to understand that at most 85% of your Social Security benefits will be subject to income taxes, and possibly even less depending on how much additional income you receive each year. This is a great benefit to this income source.

Tax-Deferred Income

This type of income is probably the most common in retirement aside from Social Security. This includes money from 401k, 457, Traditional IRA, SIMPLE or SEP IRA accounts. When you put money into these plans during your working years, the IRS gives you a tax deduction for the funds you put in based on your marginal tax rate.

Let’s use the example again of the married couple earning $120,000. If they put $20,000 into a 401k plan each year then each dollar contributed to the plan lowers their taxes by 22 cents, for a total annual tax savings of $4,400 ($20,000 * 22%).

Once retirement comes around, you can begin taking withdrawals from tax-deferred accounts at age 59 ½ and must begin taking withdrawals (called required minimum distributions or RMDs) starting at age 72. The money taken out of the account will be taxed just like your wages are taxed prior to retirement.

One of the beauties of tax-deferred accounts is that often your income needs before retirement are higher than during retirement, meaning that even though you pay taxes when funds are withdrawn, they’re typically taxed at lower rates since the withdrawn amount is less.

Tax-Free Income

Roth 401ks and Roth IRAs on the other hand create tax-free income in retirement. This is because you receive no tax deduction when contributing to these accounts during your working years. There are also no RMDs from these accounts, allowing your investments to grow for as long as you keep them there.

Being Tax-Efficient When Taking Retirement Income

Being “tax-efficient” in retirement for Social Security, Traditional IRA (including 401ks) or Roth IRA account holders usually involves being strategic about when you withdraw from which income source (assuming you have all three).

While it is typically wise for many to postpone Social Security payments until at least their full retirement age, there are no tax advantages to doing so. The tax opportunities for Social Security come after you start claiming this benefit, and are based on your “combined income” as detailed earlier.

Other tax opportunities come with when and how you withdraw funds from tax-deferred and tax-free accounts. It usually makes the most sense to withdraw from tax-deferred accounts first and from tax-free accounts last, allowing those tax-free dollars to grow and grow until absolutely needed. The temptation can be to pull funds from the tax-free accounts first, but it’s not ideal to do so.

In summary, it makes sense for most retirees to first withdraw from tax-deferred accounts to create retirement income. A simple cash flow analysis can help you know about how much you need to withdraw each month or each year. Remember, withdrawing more creates more taxable income, potentially bumping you into a higher tax bracket in any given year.

Claiming Social Security at or after your full retirement age (up to age 70) will create another income stream, of which at most 85% is counted toward taxable income. By controlling one’s income needs in a particular year, you could even reduce this rate to 50% or even 0%.

Taking funds from your Roth IRA should be your last option, so those tax-free dollars can continue to grow over time without any RMDs to speak of.