An endless variety, until you know what you're looking for.

As an early investor, stock picking fascinated me. So when I got out of college and finally started earning some decent money, I went searching.

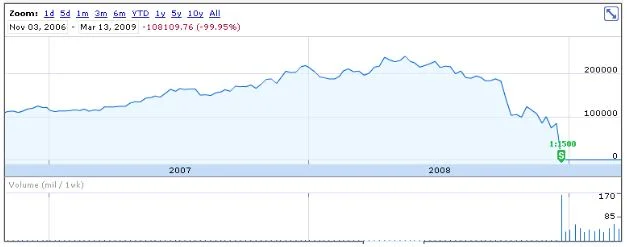

On a “hot tip” from a co-worker, I invested in a company that was earning a ton of money and seemed to have only one future path - grow, grow, grow! In late 2006 I invested what was, for me, a pretty big chunk of money. Here’s the stock’s performance from 2006 to shortly before I sold it in 2010:

This company suffered two financial disasters within a few years of my purchase: the financial crisis in 2008-2009 and a major equipment accident in 2010 that brought on significant legal liability. This company (and my investment) were sunk.

We Are Terrible Stock Pickers

I’ll point out two lessons here. First, there’s a lot of scientific evidence showing that individual investors are terrible at picking winning stocks. Sure, my investment increased from November 2006 through early 2008, but I didn’t know enough to sell the stock before the economy took a dive. Few investors did.

Second, while investing in a diversified index fund would have also resulted in a loss, most funds subsequently bounced back from the financial crisis and were scarcely impacted by the isolated event that was catastrophic to this one company.

My “winning” stock? It’s still down about 99.95% from my original purchase price.

401(k) INVESTING ISN’T STOCK PICKING

Picking investments in your 401(k) is a lot different than picking stocks. In fact few 401(k)s allow you to pick individual stocks.

As mentioned in my article, “An Introduction to Your 401(k),” typically your investment choices are restricted to mutual funds. A mutual fund is a collection of different securities, like stocks or bonds, based on a certain investment class or investment objective.

Mutual funds can hold millions of stock shares or bonds from thousands of different companies. Investing in a mutual fund allows you to buy shares of the fund, which is like purchasing small slices of each of the many individual investments within the fund.

If a mutual fund held in your 401(k) had the same investment as I did (the one that tanked 99%), your overall investment would be exposed to far less risk since you also purchased, through a mutual fund, small slices of hundreds or even thousands of other companies. This is called diversification, and it’s the shining attribute of mutual funds.

WHAT DOES RETIREMENT LOOK LIKE?

Before choosing your 401(k) investments, you need to first think about what retirement looks like. This can be difficult to answer, especially if retirement is a long way away. However, it’s one of the main drivers for what kinds of investments you’ll need in your 401(k).

The more you can envision what retirement looks like, the greater your ability to decide how much money will be needed for it to last. Here are some questions to help as a guide:

- At what age would you like to retire?

- Will you stop working entirely after retirement? Or work part-time?

- Do you plan to travel during retirement? Purchase a second home?

- Do you have a history of illness in your family that may require extra money for healthcare costs?

- Do you plan to leave an inheritance for your children, or do you want the last check you write before you die to bounce?

Your aim should be to have a retirement goal as specific as possible, such as:

“I want to retire in 25 years with an income of $60,000 per year, with all debts paid off. I want the income to last as long as I live with at least $200,000 left over for my children.”

Establishing a vision of retirement and subsequent goals will give you a tangible date to work toward and construct your 401(k) portfolio around.

A general rule for calculating how much money you’ll need for retirement is to estimate how much money you would need for living expenses each year and multiply it by 25. For example:

$60,000 x 25 = $1,500,000

WHAT IS YOUR RISK APPETITE?

Let me provide some context to “risk appetite” with this question:

If the value of your 401(k) dropped 30 percent in one year, what would you do?

- Freak out and sell everything to save the money I have left

- Hide in my basement in the fetal position and wait out the chaos

- Invest more, taking advantage of lower investment prices

- Do nothing

It’s important to know that a 30% drop in the stock market will affect some 401(k) investments more severely than others.

Take the 2008 Financial Crisis as an example. During this period, the stock market dropped around 30-40% in 2008 alone. From January to March 2009, it lost another 20% or so. That’s roughly 50-60% of its value!

I remember that time very well. I was in the first year of business school. I can’t tell you how many classmates and professors were FREAKING OUT while the stock market dropped significantly, day after day. However, the bond market actually gained a few percentage points over this same period from 2008 to March 2009.

My MBA peers’ response suggests they may have taken on more risk than they were willing to handle. Market ups and downs can be terrifying and more economic recessions are expected to occur. If you cannot stomach significant short-term losses, you may be better off choosing at least some 401(k) investments with less risk, such as bonds, in order to help level out the ups and downs.

FUND CLASSES WITHIN YOUR 401(K)

Your 401(k) will likely have a wide variety of investments to choose from. Most 401(k)s I’ve seen have between 20 and 30 choices. These investments can generally be categorized in the following way:

Money Market Funds

- U.S. Bonds or Fixed Income Funds

- International Bond Funds

- Blended Funds (a combination of stocks and bonds)

- Large Cap U.S. Stock Funds

- Mid Cap U.S. Stock Funds

- Small Cap U.S. Stock Funds

- International Stock Funds

- Emerging Markets Stock Funds

- **Target Date Funds**

If you review your 401(k) investment options, you might see something indicating the mutual funds’ “Fund Class” in the fund’s description. For instance, if you have the Vanguard 500 Index Fund as an investment option, it would be assigned the fund class “large cap.” The Vanguard Total Bond Market Index Fund would be “U.S. bonds or fixed income.”

I’ve organized the Fund Class chart to generally move from less risk to greater risk investments, with target date funds noted as a standout, since they are actually a collection of different mutual funds and their risk level varies depending on the target date.

For example, emerging market funds, which invest in countries with “emerging” economic systems, are very high on the risk scale, relative to other funds. Money market funds primarily invest in very safe, short-term investments like U.S. Treasury bills or commercial paper, placing them very low on the risk scale.

AN IMPORTANT LESSON ON RISK AND RETURN

Since low risk investments are available in 401(k)s, why not put all of your money into U.S. bonds or other fixed-income investments to keep your money growing and safer? The principal of risk/return dictates that less risky investments must return a lower rate of growth than more risky investments such as stocks.

An all bond portfolio has historically returned around 3% per year, while an all stock portfolio has returned closer to 7-10%. If you’re interested in having your 401(k) grow enough to provide for 20-30 years of retirement, some risky investments will be required.

Now let’s pull this together and help you decide which investments are right for your 401(k).

WHEN IN DOUBT, CHOOSE A TARGET DATE FUND

As recommended in this article from Betterment, if you don’t want to make your own 401(k) choices, I would suggest choosing a target date fund if they are available.

These funds invest in a variety of mutual funds based on how far away you are from retirement. If retirement is 35 years away the investments will generally be more risky. As retirement gets closer, the investments in the fund shift towards less risky ones, since you’ll have less time to recover if the stock market takes a hit.

More and more 401(k)s are providing access to target date funds, which is a great thing. These funds can take a lot of the pressure off of making your own investment decisions for retirement.

One of the downsides of target date funds is they assume you have a certain tolerance for risk strictly based on your retirement age. For example, Vanguard’s Target Retirement 2045 Fund (used by investors planning to retire around 2045) has an allocation of 90% stocks and 10% bonds.

This is a generally a good approach to getting the growth you’ll need for retirement over 30 years, but a drop in the stock market of 30-40% may leave you reeling. Target date funds don’t take your risk appetite into account. They basically say, “This is how much investment risk you should take if you want to retire at this age” regardless of the market ups and downs.

CHOOSING YOUR OWN INVESTMENTS

If you do not have access to target date funds or you prefer to make your own investment choices, I suggest starting with a retirement planning tool from your 401(k) provider’s website.

NOTE: Remember the exercise you went through to determine when you want to retire and your risk tolerance? Here is where we’ll apply it.

Many retirement planning tools allow you to enter your current age, the age you’d like to retire, and answer some questions to identify your willingness to accept investment risk. The tool will then display a recommended portfolio based on these and other variables.

If your 401(k) provider doesn’t have a resource like this, I’d suggest using one from another large investment company. This one from Vanguard would be a good start. It first asks about your financial goals. It then asks questions to help assess your willingness to accept investment risk. The result is a suggested investment allocation based on your answers.

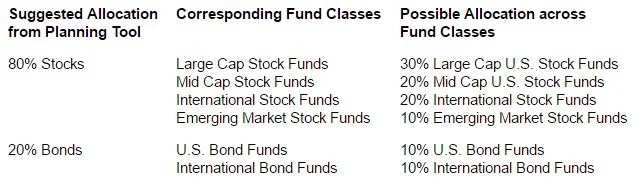

For example purposes only

Unfortunately, the tool doesn’t give you a detailed breakdown of which asset classes may be right for you. What it does do is help provide an investment allocation based on your retirement plans AND risk appetite.

From there, it’s a matter of reviewing the available asset classes in your 401(k) and selecting which funds will go into your portfolio.

Research suggests that a globally diversified, low-cost portfolio may perform better over the long-term. Depending on the investments available in your 401(k), you may benefit from exposure to various stock and bond fund classes.

For example, suppose the Vanguard Investment Planning tool suggested an allocation of 80% stocks and 20% bonds. Depending on the funds classes available in your 401(k), you could arrange your portfolio in this way:

For example purposes only

This is just one of an endless variety of options. The important things to remember are to:

- Select investments based on your risk appetite

- Select investments based on how much you need your money to grow, understanding that in order for your money to grow significantly over time, you’ll need to accept risk

TALK WITH A FEE-ONLY FINANCIAL ADVISOR

If you find yourself utterly terrified to do this yourself, and you don’t have target date funds to choose from, I suggest talking with a fee-only financial advisor. Most fee-only advisors do not sell products for a commission, allowing them to take an impartial, objective look at your retirement account and recommend allocations based on your goals.