Blair Hale, prisoner of war

After the devastating, unexpected attack on Pearl Harbor in 1941, my grandfather, Blair Hale - better known by his grandchildren as “Pop” - along with many other young American men, ran to his local military recruiting office and asked where to sign up. Pop was young, patriotic, and going to war.

Pop flew in a B-17 bomber “Flying Fortress” as a bombardier. He flew several missions over Nazi Germany, taking out key enemy targets with his 10-man crew. On one of these bombing runs his plane was shot down. Crashing toward the frigid Baltic Sea, Pop leapt from the plane and parachuted down to the icy waters. In a struggle for survival, he spotted a large military vessel and knew he was saved. Unfortunately, the vessel was German.

Planning a P.O.W. Jailbreak

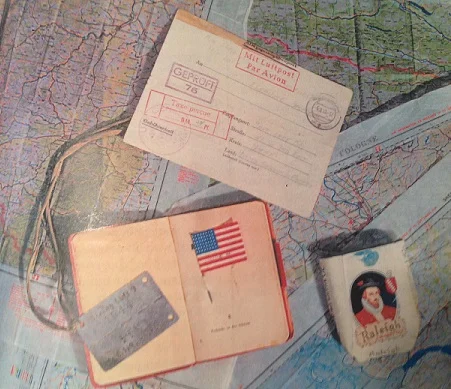

Pop was taken captive and put on a train with a one-way ticket to a German P.O.W. camp. The U.S. military had been taught that finding a means of escape was absolutely essential. Secretly stitched in the lining of Pop’s military-issued jacket, were maps of Germany. Locations of towns and cities, roadways, and escape routes to freedom and safety were all contained on these tissue paper-thin maps.

Planning a prison break--which Pop would later attempt several times--didn’t start in prison. It started well before Pop was a P.O.W., and even before his plane flew over the German line. It started when the map was stitched into his clothing.

401(k) Investors Rarely Have a Plan

I’m not about to say that preparing for retirement is like preparing for war. Pop and anyone else from “The Greatest Generation” would surely slap me upside the head for such a comparison.

I’ll only say that having a 401(k) with no plan is like escaping a P.O.W. camp without a map--unsure of whether you’re heading towards your French allies’ border or the Brandenburg Gate.

Many of us have a 401(k) because we’ve been told it’s one of the best tools to save for retirement. I absolutely agree. However, most 401(k) investors feel like they’re behind enemy lines with an unmarked map, with no answers to important questions like

- How much will I actually need for retirement?

- How do I ensure that what I’m saving today will be enough?

- Which investments should I choose?

- What do I do when the market drops again?

- What if I need to take money out early?

Your 401(k) Starts with a Plan

I created this a series to help you form a solid roadmap for your 401(k)--to make it do what it was meant to do. By the end you’ll have a step-by step process for using your 401(k) to help you build wealth for the future.

A 401(k) Plan Framework

So how can you start to put together your 401(k) plan? A group called the CFP Board created a step-by-step process of what they believe should go into a financial planning relationship. It’s a way for financial planners to walk a client through the planning process, clearly and methodically, without missing any important areas.

Gather client data and goals

Analyze and evaluate the client’s current financial status

Develop and present recommendations and/or alternatives

Implement the recommendations

Monitor the recommendations

For the everyday investor, I believe the process can be tailored to create a personal 401(k) plan for maximizing your 401(k)’s wealth-building potential.

- Gather 401(k) data and develop financial goals

- Analyze and evaluate your current financial status

- Develop your 401(k) investment plan

- Select your 401(k) investments

- Monitor your 401(k) investments

Now that we have the framework you can use to form a plan, we’ll dive deeper into each of the five steps and see how they apply to your 401(k) and overall financial picture.

By the end of this series you should have a powerful, well-crafted plan for your 401(k).