This retirement train ain’t goin’ nowhere. Photo by Trevor McKinnon on Unsplash

I’ve been surprised at how many conversations I’ve had with retirees about debt over the last few years, and how to get it paid off before they officially retire. Frankly it’s a relief, since I believe all retirees should head into retirement debt free.

The consequences of not doing so, in my view, can severely cramp your retirement lifestyle. I’d like to talk a bit about this in today’s post.

The most common forms of debt I see with pre-retiree clients are mortgages, credit cards, and auto loans. All of these are bad, but some are more terrible than others. Let’s break down the downsides of mortgages and credit cards, and consider a better approach to debt as you look toward retirement.

Bad Retirement Debt: Mortgages

If you had to choose any sort of debt to carry into retirement, I suppose you could justify a mortgage, but only in rare cases. The fact is, your mortgage payment is likely your largest ongoing monthly expense and will continue to be in your retirement years.

If you’re at the tail end of your 30 year mortgage then inflation has likely resulted in your monthly payment feeling “smaller” than it felt 25 years ago. The average home price in 2000 was $119,000. If you assume a mortgage rate of 4.00% then that’s a principal and interest payment of $568 per month.

As a consequence of inflation over time, $568 probably feels like nothing in 2022 versus 2000, but do you really want to carry that payment into retirement on a fixed income? Not to mention your property taxes, which increase as your home appreciates, and maintenance expenses, which increase as your home ages?

Think of what an extra $568 PER MONTH in retirement would mean to you when you’re on a fixed income. Medical expenses, vacation money…the list goes on.

Ugly Retirement Debt: Credit Cards

If you’re going to mercilessly attack any debt prior to retirement (and hopefully WELL before you retire) it should be credit card debt. I can think of a few justifiable reasons for carrying any sort of balance on credit cards, especially as you move into the fixed income world of retirement.

With an average credit card interest rate of 18%, any interest saved elsewhere or gains made on an investment portfolio likely pale in comparison, and certainly don’t come with guarantees. On the other hand, you’re guaranteed to be charged 18% annually by your credit card company.

On the lighter side, you’re guaranteed to save (read: earn!) 18% by paying off your credit card as aggressively as possible.

Consider this example. Dave has credit card debt of $15,000 at 18%. If he continues to make his monthly payment of $350, he will rack up $7,950 in interest over 5 years before his card is paid off. Can you think of something else you could spend $7,950 on in retirement, rather than paying it to a corporate behemoth like Visa or American Express? Me too. I could fund four high-end vacations with that money!

A Better Way

Folks, there’s a better way to head into retirement than financial baggage like this. Make the decision to aggressively pay off debt before retirement. I promise you won’t regret it.

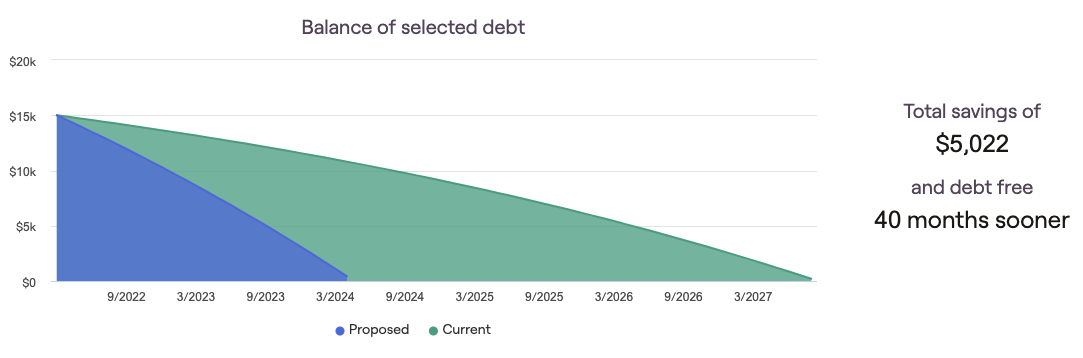

Here’s an example. If Dave decided to get really serious about paying off his credit card debt before retirement by paying an extra $350 per month, he would have his credit card paid off 40 years sooner and save over $5,000 in interest. Cha-ching!

What if Dave went totally gangbusters and upped his extra payment to $500 per month? He’d be credit card debt free in about 18 months and save $5,625 in interest.

Think about Dave ignoring this extra debt and carrying it into his retirement. We all know how credit card debt feels. It’s like a ball and chain, a millstone around your neck that you need to drag around endlessly. Let me tell you, it will feel all the more intense of a burden in retirement.

If you have mortgage or credit card debt but don’t think you have extra cash to pay it off sooner, I call boloney. Your income is likely high enough, with plenty of room to tighten your belt for a couple years with some planning and discipline.

I’ve been there before. When I quit my job in Salt Lake to start Hale Financial, my income went down by about 80%. Guess what? I found a way to survive and still got to eat out at Burger King and catch a movie with my wife once in a while. You can too.

I hope this is helpful, and not written in too strong of a tone! I’ve been in this business long enough to know how heavy debt can sabotage one’s retirement, and how thrilled my clients are when they become totally debt free. Their reaction is nothing short of thrilled emotion, and worth every sacrifice they’ve made. It would be the same for you.